Tuesday, 02 July 2019|Source:CHINA CHAMBER OF COMMERCEFOR IMPORT&EXPORT OF MEDICINES &HEALTH PRODUCTS|Author:Li Guiying and Zhang Zhongpeng, Department of Health and Nutrition

CCCMPHIE will release the Report on Dietary Supplement Industry (2019) (the “Report”) at the HNC2019 on June 21, 2019. The Report introduces the dietary supplement industry from a panoramic perspective, provides insights into the development characteristics of the dietary supplement industry, comprehensively combs and analyzes the management thinking, market situation and international trade of dietary supplements, and predicts the development trend of the industry at an angle of the development of the whole industry. The data is authentic and reliable, highlighting characteristics of globalization, profession and predictability.

Authoritative interpretation of industry status and market data

Based on the China Customs data, this Report provides an authoritative interpretation of industry and market data. At present, the dietary supplement market in Asia has surpassed the Europe to become the world’s second largest dietary supplement consumption market, and China is the largest dietary supplement consumption market in Asia.

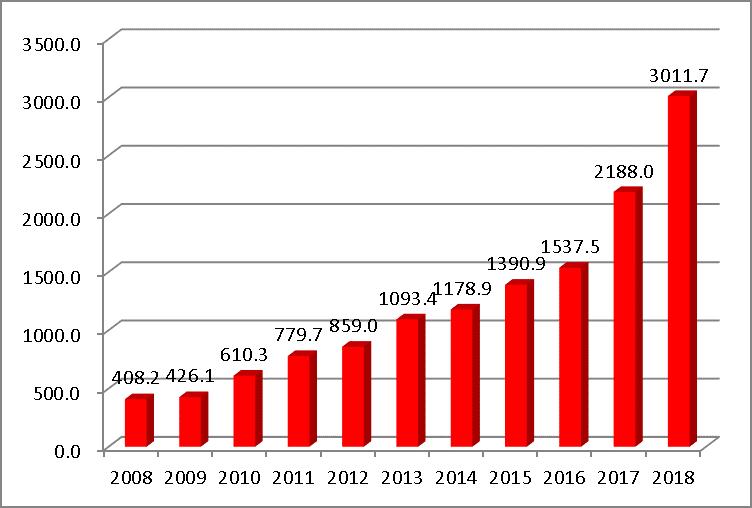

According to statistics, the size of Chinese dietary supplement market exceeded 460 billion yuan in 2018, plus special foods such as QS/SC and special medical foods, Chinese nutrition and health product market totaled more than 750 billion yuan in 2018. In 2018, the import and export values of Chinese dietary supplements grew a record 31.5% to US$4.68 billion, among which the export value was US$1.67 billion, up by 21.8% than the last year. The main export markets were the United States, Hong Kong, Japan, Indonesia and other countries and the provinces and cities with highest export values were Jiangsu Province, Guangdong Province, Shanghai Municipality, Shandong Province and Zhejiang Province. The import value of dietary supplements in 2018 was US$3.01 billion, increased by 37.7% year on year. Imported products mainly came from Australia, the United States and Germany. The provinces and cities with large import values were Guangdong Province, Zhejiang Province, Shanghai Municipality and Beijing Municipality. The above-mentioned regions are economically developed and have strong ability for consuming health products, as well as boast thriving e-commerce, especially cross-border e-commerce.

Figure: Import scale of dietary supplements from 2008 to 2018

Comprehensive analysis of international trade development

API is the guarantee and foundation for the quality of dietary supplements, and China is the world’s major producer and exporter of APIs for dietary supplements. According to the import and export data of APIs, the global market situations and development trends of dietary supplements can be predicted. According to China Customs data, this Report comprehensively analyzes the imports and exports of main API categories for dietary supplements in 2018, which is a highlight of this Report. From the perspective of exports, vitamins, amino acids, and plant extracts are the main categories of exported Chinese APIs (among them, vitamins rank the first, followed by amino acids) and their exports are growing. From the perspective of imports, amino acids, plant extracts, and vitamins are also the main categories of imported APIs.

Insight into market hotspots, and analysis of key categories

Based on the analysis of industrial development, this Report analyzes the policy environment, population structure, and consumption concept towards dietary supplements, and highlights the hot products on the market. With the changes in population structure and consumption concept, the current hot products include probiotics, products for bone and joint health, sports-related nutrition and beauty products, and products for eye health. For single-category hot products, fish oil capsules, protein powder, vitamins, and dietary fiber are in the list. With regard to the channels of retail pharmacies, vitamins, laxatives and products for increasing bone density and enhancing immunity sell well.

Trend prediction to guide industrial development

This Report analyzes and predicts future consumption trends, R&D trends, and development trends of various categories. With the expansion of the market and the intensification of competition, finished product R&D enterprises should make every effort to develop product technologies from various dimensions so as to further seek product differentiation and originality. The Report suggests some development directions for the dietary supplement industry: vitamins and minerals will continue to be the largest categories, the demand for dietary supplements in segment markets is strong, Generation Z will become the largest consumer groups of dietary supplements, and targeted nutrition products (individual demands) will be the development trend of the industry.